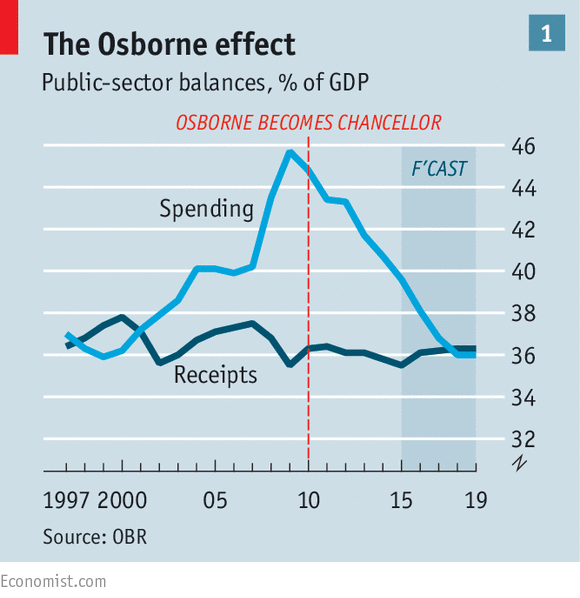

This means that Mr Osborne is nearing his goal of closing the deficit. When the coalition came to power in 2010, the Conservatives argued that Britain's structural budget of 9% of GDP was a danger to the economy and vowed to close it. Along with the Liberal Democrats, they undertook austerity measures which saw a fifth of departmental budgets being cut.

This means that Mr Osborne is nearing his goal of closing the deficit. When the coalition came to power in 2010, the Conservatives argued that Britain's structural budget of 9% of GDP was a danger to the economy and vowed to close it. Along with the Liberal Democrats, they undertook austerity measures which saw a fifth of departmental budgets being cut. The euro zone crisis and an economic slump in Britain resulted in the chancellor discarding his plan of closing the structural deficit by 2015. The date has been pushed to 2018 instead. And there was some good news on that score. Britain's fiscal watchdog, the Office for Budget Responsibility (OBR) revised down its prediction for borrowing by £1 billion- 2 billion a year for most of the next parliament. The national debt as a proportion of GDP would come down in 2015-16. Mr Osborne was adamant that this budget was fully funded.

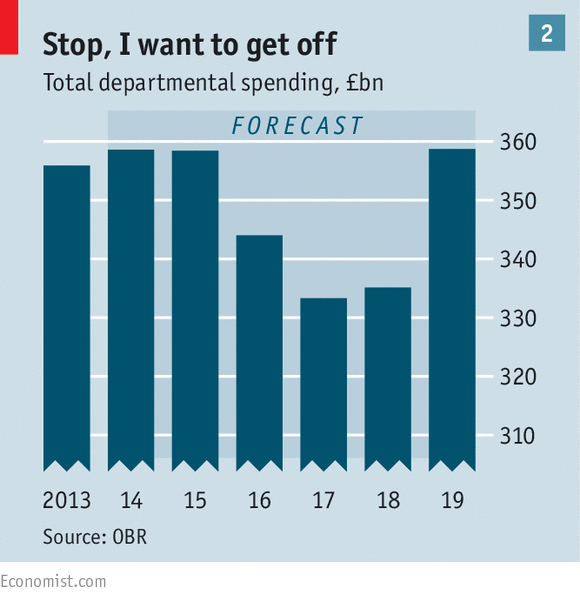

The euro zone crisis and an economic slump in Britain resulted in the chancellor discarding his plan of closing the structural deficit by 2015. The date has been pushed to 2018 instead. And there was some good news on that score. Britain's fiscal watchdog, the Office for Budget Responsibility (OBR) revised down its prediction for borrowing by £1 billion- 2 billion a year for most of the next parliament. The national debt as a proportion of GDP would come down in 2015-16. Mr Osborne was adamant that this budget was fully funded.His policy announcements can confirm this but the same cannot be said about his plans for total spending. The chancellor plans on making deep cuts to public spending for the next two years. This is deeper than any annual cuts under the coalition government. The cuts will enable him to keep his promise of balancing the budget to achieve a surplus in 2018-19.

However, on Mr Osborne's new plan, daily departmental spending would rise by £24 billion in the last year of the next government (the biggest increase in ten years). In cash terms, this totally goes against the prior consolidation even though growth ensures the books still balance. Taking into account economic growth would mean that departmental spending would be 9% higher at £31 billion. This could also mean cuts that are ultimately only about half as bad as they were facing before Mr Osborne for departments outside the protective ring-fence consisting of the NHS, schools and international aid.

This is a ruse but overall good politics. The chancellor had implied in the autumn statement in December that he planned to reduce public spending to 35% of GDP by the end of the next government, the lowest since the 1930s. The Labour party pounced on that opportunity, accusing Mr Osborne of undoing the post-war welfare state. This was effective when applied to man from a well-to-do background but his plan appears to have deflected that.

The budget was more than just deception because most Britons will benefit from an increase in the amount earned before paying taxes. It will be raised to £10, 800 in 2016-17 and £11, 000 the next year, adding £80 to most pay packets. This was a popular Liberal Democrat idea. The Tories and the Lib Dems promised to raise it to £12, 500 if re-elected, which would mean that those on minimum wage would not have to pay tax at all. But the threshold is already so high that according to the Institute of Fiscal Studies (a think-tank), the poorest fifth of workers did not have to pay income tax in 2014. The latest rise benefits the middle and high income earners more than lower ones.

Besides that, the chancellor announced more sweeteners. Those saving for their first home will receive subsidies of up to £3000 each. But increasing demand without supply will cause prices to rise, benefitting homeowners the most. Other plans include a tax reduction for the North Sea oil industry (the only section of the economy to have suffered because of the falling oil prices) and a plan to devolve more tax revenue to Manchester. This would be paid for by three sources of revenue: a clampdown on tax avoidance, higher taxes on banks (these two are bound to be popular) and lower tax subsidies for huge pension pots (Labour announced this policy just weeks ago).

On the whole, the budget was an odd mix. The chancellor aimed to show responsibility by ensuring that his pre-election plans are fully funded. On the other hand, his plan will sacrifice credibility for political advantage. He formed the OBR to prevent chancellors from manipulating the growth forecasts but he has now demonstrated that the spending figures can be tampered with.

No comments:

Post a Comment